Health fund fees calculations as a percentage of the MBS fee

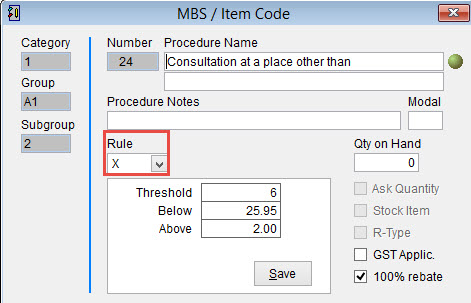

eClaims can calculate health fund fees if they pay a specified percentage more than the MBS item number base rate for items that use the external (X) calculation rule. For more information refer to Medicare item rules.

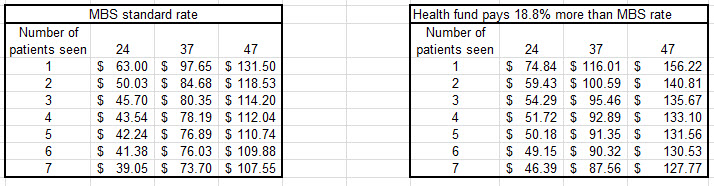

Example : The health fund pay 18.8% more than the MBS fee on item number 24.

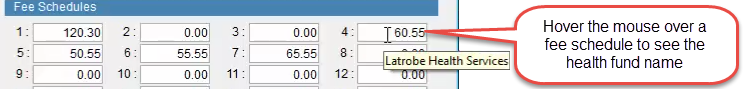

Before adding fees ensure that the fund is in eClaims and has a fee schedule selected. Refer to health fund fee schedule for more information.

Fees can be manually entered by opening the item number directly or imported from an excel file as noted below.

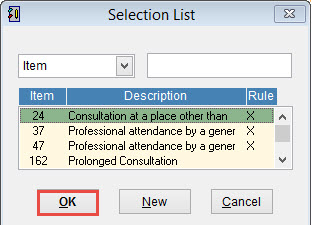

Click Patient and MBS / Item Codes from the main menu of eClaims.

Click on the item number so that it is highlighted and click OK to view the details of the item number.

Place the mouse over a fee schedule IE 4 and the health fund assigned to that schedule will be displayed. IE Latrobe Health Services.

Select the fee schedule for the fund and enter the amount to be added in addition to the standard MBS rate displayed in fee schedule 1.

If the fund pays 18.8% more than the MBS fee then enter 1188.00 as the amount in the fee schedule for that fund. If the fund pays 29.697% then enter 1296.97 as the amount. The figure must be entered as a 4 digit number with 2 decimal places.

Item 24,37 and 47 use this calculation when calculating health fund fees. This item is calculated according to the number of patients seen by the service provider at an external location.

For item 24 if 1 patient is seen the standard MBS fee is $63.00. If 1188.00 is added as the fee in the fee schedule for the health fund the amount billed will be $74.84 (18.8% more than the MBS fee) per the table above.

Importing Health Fund fees from an excel table.

Please refer to How to import Health Fund Fees or How to import AMA Fees